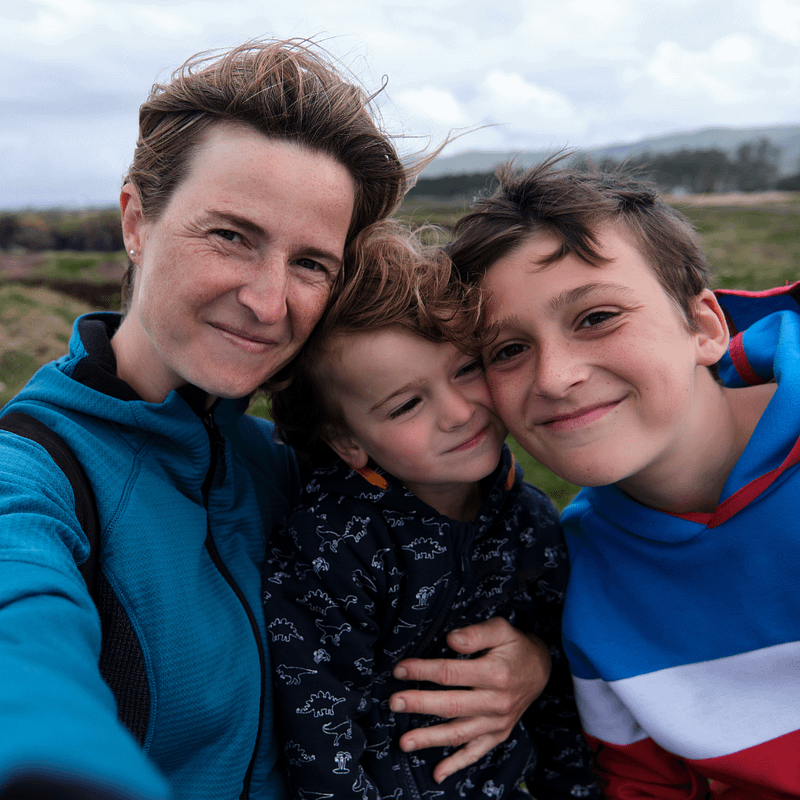

What Single Parents Should Know about Estate Planning

It is no secret that being a single parent is challenging. In addition to the day-to-day struggles of raising children on your own, you may also have concerns about what the future might hold for your kids if anything were to happen to you. While estate planning for single parents is similar to estate planning […]

Estate Planning Lessons from Disney’s Encanto

In the early part of 2022, many young families spent a lot of time watching Disney’s award-winning animated film Encanto. Repeatedly. While the movie is obviously a great source of entertainment for kids, estate planning attorneys have also noticed that it contains a lot of valuable lessons that can help people prepare for their family’s […]

The Most Important Estate Planning “To Dos” After a Divorce

Going through a divorce can be painful, overwhelming, and stressful. It’s the end of one chapter and the start of another in your life. Although it might be the right decision, you’re forced to confront various issues. For example, you and your ex must agree to the terms of the divorce, such as child support, […]

What Is the Process of Administering an Estate in Court?

The probate process entails judicial officials, such as probate judges, processing the will of a decedent. State probate laws may vary, but the general process is similar across the country. Probate is the process of proving a decedent’s will. A probate judge will also oversee cases where the deceased person did not prepare a will, […]

It’s Essential to Communicate Your Estate Plan Goals with Family

Preparing for a successful transfer of wealth to your loved ones begins with a comprehensive estate plan. However, many of us often overlook the crucial part of communicating our estate plan to family and heirs. Even with a thorough and up-to-date estate plan, your family may experience emotional or financial turmoil despite your best efforts. […]

When Is Probate Unavoidable?

While probate may seem expensive and complicated, it is a standard step in formalizing how assets pass to heirs or beneficiaries. Whether or not you require probate depends on the type of property and how you own it, and the state laws in which you live. While probate can be a complex process for vast […]

The 5 Must-Haves for New York Estate Plan

As we age, the need for estate planning becomes even more vital. Many people avoid estate planning, because they do not want to think about the end of life, failing health or disability. Others believe that an estate plan is only for rich people. However, an estate plan is helpful for the senior adult and […]

Estate Planning Is Essential to Being Prepared

It makes sense that more aging Americans have completed wills and estate plans compared to younger Americans. Still, a significant number — 19 percent of those over age 72 and 42 percent of those between 53 and 71, according to survey data — lack any type of estate plan. Although managing these details can seem […]

Creating a Letter Of Instruction To Go With Your Estate Plan

It doesn’t matter whether you are starting from scratch or have an estate plan in place, a letter of instruction (LOI) is an important part of any comprehensive plan. A letter of instruction can help your loved ones manage important information about you. An LOI conveys your desires, includes practical information about where to find […]