Many people procrastinate about creating an Estate Plan. Here are the Top 5 reasons why you should create an estate plan now

-

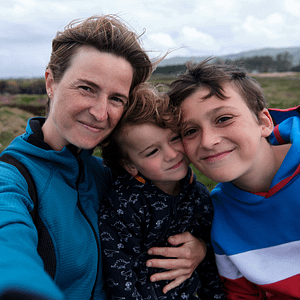

1. Minor Children- In the event of a catastrophic accident making sure that your children are cared for in the event of you and your partners death is absolutely necessary. With some simple estate planning you can designate a guardian who would take care of your children in the event of a disaster.

-

2. Intestacy- New York has a default estate plan for you if you die without a will. This can possibly mean leaving money outright to an eighteen year old so they can spend it on a Corvette instead of College or having your estate pass to your Uncle George who you despise.

-

3. Guardianship- Besides a will, a power of attorney and health care proxy are necessary for your estate plan. If you do not have these documents and you become incapacitated a Guardianship proceeding may be brought for you and this proceeding can be very costly.

-

4. Protecting Beneficiaries- If you have a beneficiary who is receiving public benefits such as Medicaid, an inheritance might disqualify them from these public benefits. A supplemental needs trust can be created so that the beneficiary would not become disqualified from public benefits and this money could be used to supplement their care.

-

5. Reduce or Avoid Estate Tax- The use of disclaimer wills or trusts can reduce or completely avoid New York Estate tax.